Are you tired of living paycheck to paycheck, wondering where all your money goes? You're not alone! Many people struggle with managing their finances effectively. Luckily, we’re in the 21st century, where technology offers a plethora of tools designed to help you get your finances in check. In this article, we’ll explore the best personal finance tracking apps for beginners, guide you through the process of creating a personal finance tracking spreadsheet, and introduce you to some free personal finance tracking tools for budgeting. Let’s dive in and get your money game on point!

Why Personal Finance Tracking is Crucial

Personal finance tracking isn’t just about knowing your bank balance; it’s about understanding your financial health. Studies show that people who track their finances are more likely to save money and achieve financial goals. Here’s why you should consider personal finance tracking methods for effective savings:

- Awareness: You’ll know exactly where your money is going each month.

- Budgeting: Helps you stick to a budget and avoid unnecessary expenses.

- Goal Setting: Facilitates setting and achieving financial goals, whether saving for a vacation or paying off debt.

A recent survey revealed that 70% of people who track their finances regularly report feeling more in control of their money. So, what are you waiting for? Let’s explore the tools that can make this tracking a breeze!

The Best Personal Finance Tracking Apps for Beginners

If you're looking for user-friendly tools to kickstart your financial journey, these apps are worth checking out:

1. Mint

Mint is a perennial favorite among personal finance newbies. With its sleek interface and intuitive design, it allows you to connect all your accounts in one place.

- Features: Budget tracking, bill reminders, and free credit score monitoring.

- Pros: User-friendly, accessible on both mobile and web, and it’s free!

- Cons: Ads can be a bit distracting.

Case Study: A user named Sarah started using Mint to track her spending. Within three months, she identified areas to cut back and saved an additional $200 a month!

2. Personal Capital

For those who want a bit more than just budgeting, Personal Capital offers a comprehensive view of your financial landscape.

- Features: Investment tracking and retirement planning tools.

- Pros: Great for tracking investment growth and net worth.

- Cons: The free version is limited compared to the investment advisory service.

Statistic: Users report an average increase of 10% in their investment returns by utilizing the financial planning tools offered by Personal Capital.

3. YNAB (You Need A Budget)

YNAB takes a proactive approach to budgeting, teaching users to allocate every dollar to a specific category.

- Features: Real-time tracking, goal setting, and a robust community.

- Pros: Helps you break the paycheck-to-paycheck cycle.

- Cons: Monthly fee after the free trial.

Example: After implementing YNAB, a user named Tom was able to save for a down payment on a house in just under a year!

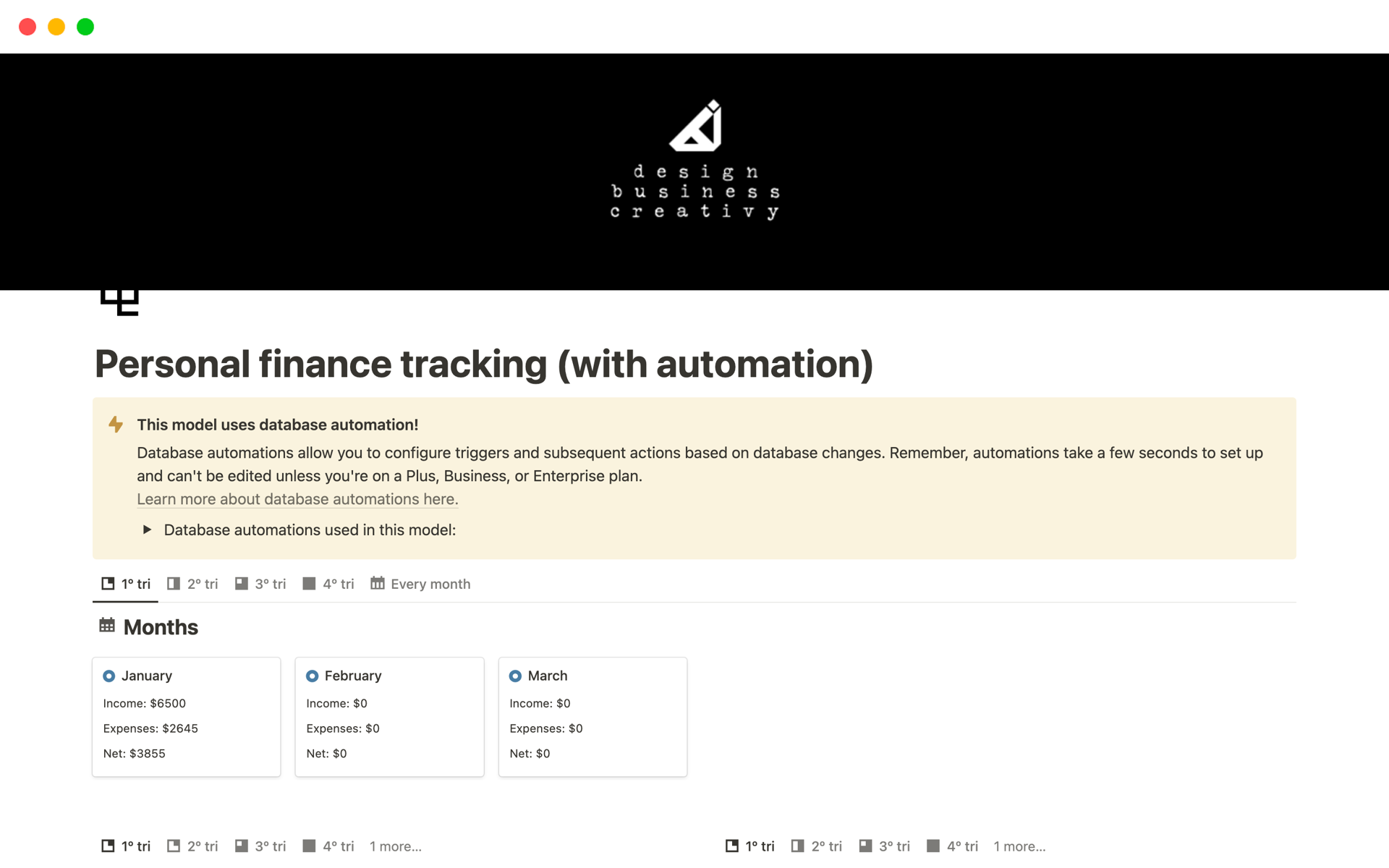

How to Create a Personal Finance Tracking Spreadsheet

Not everyone wants to rely solely on apps. Some prefer the good old Excel or Google Sheets method. Here’s a step-by-step guide to personal finance tracking using a spreadsheet:

Step 1: Set Up Your Categories

Create categories based on your spending habits. Common categories include:

- Housing (Rent/Mortgage)

- Utilities

- Groceries

- Entertainment

- Savings

Step 2: Track Your Income and Expenses

Every month, input your income and expenses under their respective categories. Don’t forget to include irregular income sources, like freelance work or bonuses!

Step 3: Analyze Your Data

At the end of each month, review your spending. Are there categories where you overspent? Adjust your budget for the next month accordingly.

Step 4: Set Savings Goals

Use the spreadsheet to set and track your savings goals. Whether it’s for an emergency fund or a vacation, seeing your progress can motivate you to save more.

Step 5: Keep It Updated

Regularly update your spreadsheet (ideally weekly) to maintain an accurate picture of your finances.

Free Personal Finance Tracking Tools for Budgeting

Not everyone wants to shell out money for premium finance tools. Thankfully, there are plenty of free personal finance tracking tools available that can help you budget effectively.

1. EveryDollar

Created by financial guru Dave Ramsey, EveryDollar simplifies budgeting with its zero-based budgeting method.

- Pros: User-friendly and straightforward. The free version is quite sufficient for most users.

- Cons: Limited features in the free version compared to the paid one.

2. GoodBudget

GoodBudget is a virtual envelope budgeting tool that allows you to track your spending without linking bank accounts.

- Pros: Ideal for cash-based budgeting and works on multiple devices.

- Cons: Some users may find it less intuitive than other apps.

3. PocketGuard

PocketGuard tracks your income, bills, and spending, showing you how much money you have left to spend after essential expenses.

- Pros: Great for visual learners with its clear, straightforward layout.

- Cons: Limited features in the free version.

Personal Finance Tracking Methods for Effective Savings

Tracking your finances is just one part of the equation; you also need to ensure your savings methods are effective. Here are some tried-and-true methods:

- The 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings. This method provides a clear framework for budgeting.

- Automate Your Savings: Set up automatic transfers to savings accounts to ensure you save before you spend.

- Track Your Progress: Regularly review your savings goals and adjust your budget as needed to stay on track.

Conclusion

Mastering your finances doesn’t have to be overwhelming. With the best personal finance tracking apps for beginners, a simple spreadsheet, and some free tools, you can take control of your financial future. Remember, tracking your finances is the first step towards effective budgeting and savings.

So, what are you waiting for? Start using these tools today and watch your financial health flourish! Got any personal finance tracking tips? Share them in the comments below!